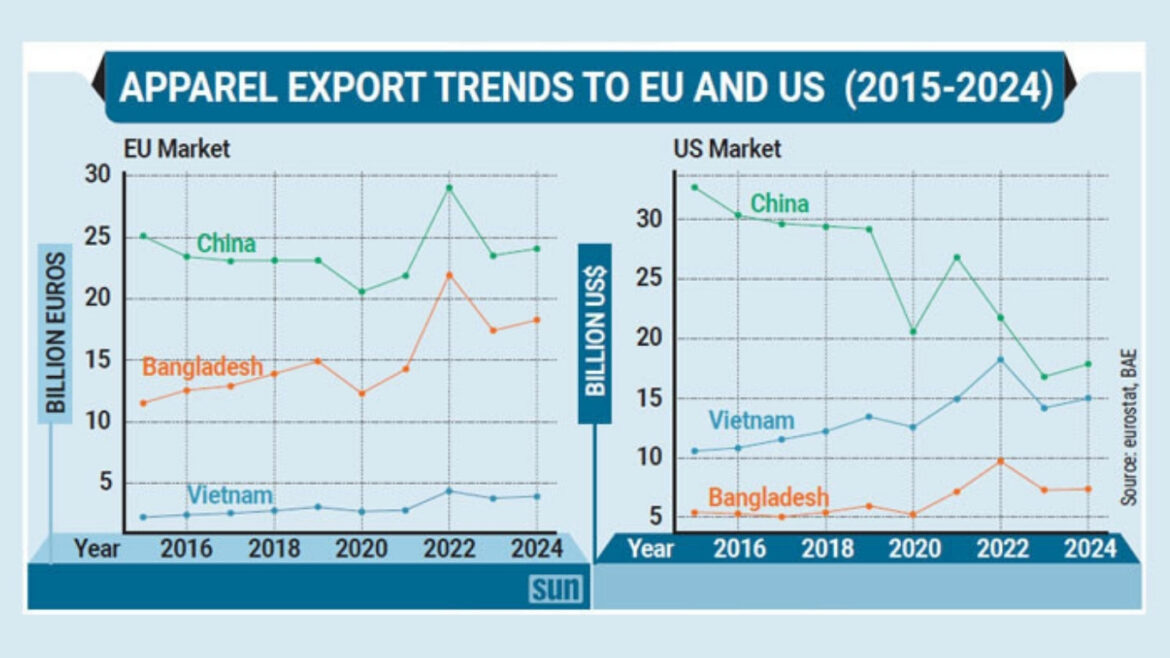

Bangladesh’s readymade garment (RMG) exports have achieved remarkable growth in the European Union (EU) and United States markets over the last decade, thanks to competitive prices, cheap labour, large production capacity, and buyers’ trust in the industry.

According to data from Eurostat and the US Office of Textiles and Apparel (OTEXA), compiled by the Bangladesh Apparel Exchange (BAE), exports to the EU — Bangladesh’s largest market — rose 58.45% to $18.27 billion in 2024, up from $11.53 billion in 2015.

Similarly, exports to the US, the single-biggest destination, grew 35.87% to $7.34 billion in 2024 from $5.4 billion in 2015.

Industry Demands Policy Support

Industry leaders say this growth can continue if the government provides lower bank interest rates, reliable and affordable energy, improved port facilities, and strong law and order under an elected government.

BGMEA President Mahmud Hasan Khan said part of the growth came from orders shifting away from China. He stressed the need for government policy support to expand further.

BKMEA President Mohammad Hatem warned that upcoming EU rules such as the Corporate Sustainability Due Diligence Directive (CSDDD) and the European Green Deal will make compliance harder, with stricter demands on sustainability, labour rights, and supply chain transparency.

EU Recovery After Pandemic

BAE Managing Director Mohiuddin Rubel noted that EU apparel imports grew 20.47% over the past decade. The pandemic reduced growth to 14.31% in 2020, but it bounced back to 24.92% afterwards.

Bangladesh followed a similar trend: exports dropped 17.64% during the pandemic but recovered strongly with 48.34% growth by 2024, totalling 58.45% growth over the decade.

US Market Needs Value-Added Focus

Rubel, who is also Additional Managing Director of Denim Expert Ltd, said US apparel import volumes actually fell 5.30% in the past decade.

Competitors had mixed results:

-

China down 18.36%

-

Indonesia down 19.82%

-

Vietnam up 32.96%

-

India up 34.13%

-

Bangladesh up 26.62%

In unit prices, the global average fell 1.71%. China (-33.80%) and India (-4.56%) saw drops, while Vietnam (+6.64%), Indonesia (+7.38%), and Cambodia (+38.31%) recorded increases. Bangladesh also achieved a 7.30% rise.

Rubel explained that Bangladesh’s unit prices are now close to the global average, but competitors like Vietnam and India earn more because of higher-value products.

He gave Vietnam as an example: in 2024, its export value was close to China’s, but volume was less than half since its unit price was $3.59, compared to China’s $1.78.

Rubel said Bangladesh must focus on value-added products to strengthen its position in the US market.