The incoming government is set to assume office at a time when Bangladesh’s economy remains under considerable strain, despite efforts over the past 18 months to stabilise it.

Although the interim administration prevented a full-scale financial collapse following the political upheaval of August 2024, deep structural vulnerabilities persist.

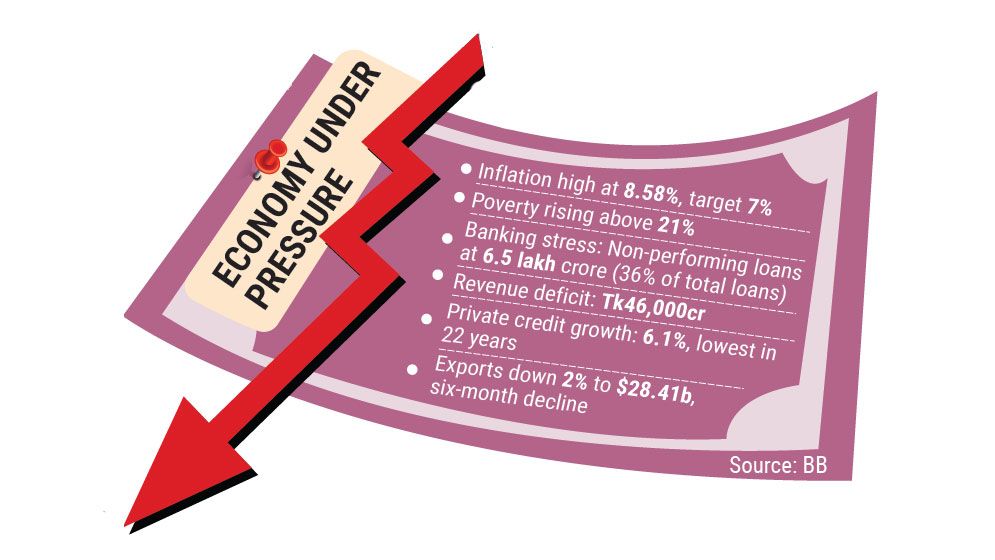

High inflation, rising poverty, record non-performing loans, weak investment, declining exports and mounting fiscal pressure now define the economic landscape, presenting the new government with one of the most challenging starting points in recent history.

Former lead economist of the World Bank’s Dhaka office, Zahid Hussain, told the Daily Sun that managing the immediate economic fallout after the fall of the Sheikh Hasina government was the interim administration’s biggest challenge.

“While the economy did not collapse, it also failed to regain meaningful momentum. Inflation could not be brought under control, and poverty has increased,” he said.

He noted that contractionary monetary policy dampened business activity, while political uncertainty and high lending rates stalled both domestic and foreign investment, pushing GDP growth to a very low level.

Mustafa K Mujeri, former director general of the Bangladesh Institute of Development Studies (BIDS), said the economy has been in a prolonged slowdown. Although reforms were initiated in the revenue system, collection declined amid instability.

“With lower revenue and higher expenditure, the new government will face a significant fiscal deficit. Given the fragile banking sector, heavy government borrowing could crowd out private credit and intensify economic pressure,” he warned.

High inflation, rising poverty

Before the fall of the Awami League government, inflation had surged to 11.66%.

After taking office, the administration led by Muhammad Yunus adopted a contractionary monetary policy through the Bangladesh Bank, halting monetary expansion and raising lending rates to curb price pressures.

In the revised budget for the fiscal 2025-26, the inflation target has been set at 7%.

According to the Bangladesh Bureau of Statistics (BBS), overall inflation eased to 8.58% in January, though it remains well above the target.

Elevated prices have eroded purchasing power and increased poverty.

The World Bank estimates that poverty rose from 18.7% in 2022 to over 21% by the end of 2025. The Power and Participation Research Centre (PPRC) places the rate even higher, at 27.93%.

Banking sector distress

The banking sector was severely weakened by alleged irregularities during the Awami League government, triggering liquidity shortages in several institutions.

The Yunus administration dissolved boards accused of misconduct, reconstituted management and pledged tighter loan governance.

Five struggling Islamic banks were merged into a new entity, Sammilito Islami Bank, in an effort to restore stability. Economists say legal and structural reforms have brought some order, but risks remain acute.

According to Bangladesh Bank, non-performing loans exceeded Tk6.5 lakh crore in 2025, accounting for 36% of total outstanding loans, the highest level on record.

Investment and export slump

To tame inflation, authorities maintained high interest rates, discouraging borrowing and investment.

Domestic investment remained subdued over the past 18 months, while political instability and deteriorating law and order discouraged foreign investors. Investment summits failed to attract significant capital inflows.

Private sector credit growth, a key driver of investment, slowed to 6.10% year-on-year in December, the lowest in 22 years.

Exports have declined for six consecutive months. Exporters attribute the downturn partly to retaliatory tariffs imposed during the presidency of Donald Trump, which have heightened global trade uncertainty.

According to the Export Promotion Bureau (EPB), export earnings in the first seven months (July-January) of the current fiscal year fell nearly 2% year-on-year to US$28.41 billion.

Meanwhile, the revenue deficit in July-December reached Tk46,000 crore, further tightening fiscal space.

Remittance surge, reserve relief

One notable success of the interim government has been the strong growth in remittances and foreign exchange reserves.

For the first time, remittance inflows exceeded $3 billion in both December and January consecutively.

In the first seven months and nine days of FY26, expatriates sent $20.56 billion, a 22.28% increase from the previous fiscal year.

When the Hasina government fell on 5 August 2024, reserves had dropped below $20 billion.

Over the past 18 months, higher remittance inflows and nearly $5 billion in central bank dollar purchases strengthened reserves.

As of 9 February, reserves stood at $29.47 billion under the IMF’s BPM6 calculation and $34.06 billion in gross terms.

No repatriated funds yet

On 28 August 2024, the interim government formed a white paper committee to assess alleged money laundering during the previous administration.

The report claimed that approximately $234 billion had been siphoned abroad over 15 years through 28 channels.

A “Stolen Asset Recovery” taskforce was later formed to retrieve laundered funds.

Over the past 18 months, assets worth Tk55,638 crore have been attached domestically and Tk10,508 crore abroad, bringing total frozen assets to Tk66,146 crore.

However, Finance Adviser Salehuddin Ahmed said on 10 February that recovering laundered funds remains complex and depends on international mechanisms such as Mutual Legal Assistance.

He noted that a future elected government may be better positioned to pursue full recovery using the groundwork already laid.